How Social Media Endangers Your Insurance Claim

Download this episode:

On iTunes | On Stitcher

Social media can keep us connected, but what we post can also haunt us in unanticipated ways. This is especially true if you’ve filed an insurance claim, such as a disability insurance claim, a workers compensation claim, a personal injury claim or auto insurance claim.

Here’s how social media can be used against you in these insurance claims and what you can do about it.

Social Media Use Is On The Rise

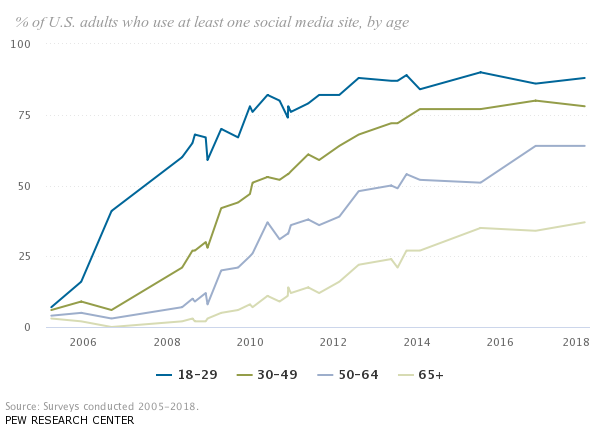

According to the Pew Research Center, when they began tracking social media adoption in 2005, just 5% of American adults used at least one of these platforms. By 2011 that share had risen to half of all Americans, and today 69% of the public uses some type of social media.

While young adults are among the earliest social media adopters, use among older adults has also increased in recent years.

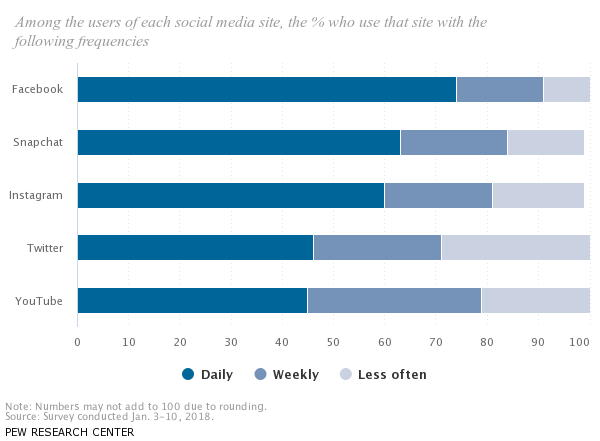

Facebook, in particular, remains popular among most Americans. Approximately two-thirds of U.S. adults – or 68% – report they use Facebook, and 75% of those users access Facebook daily.

Pew Research Center also reports that regardless of platform, social media use is a regular part of daily life for many Americans:

How Insurance Companies Use Your Information Against You

Insurance companies use social media to uncover information that may conflict with or contradict information presented in your insurance claim. In some cases this is a good thing, because it can uncover many cases of insurance fraud.

The FBI estimates the total cost of insurance fraud (non-health insurance) to be more than $40 billion per year. This costs the average U.S. family between $400 and $700 per year in the form of increased premiums, and costs the average consumer approximately $900 per year in reduced compensation.

However, social media investigations can also be used against those who have legitimate claims. Claims investigators will:

Use your content to build a “history of behavior” that supports their assertions and invalidates your claim.

Social media findings are usually combined with traditional surveillance tactics, which include recording or videotaping you when you are in public areas. Investigators will attempt to catch you doing activities that are inconsistent with the physical and mental limitations and restrictions of your disability.

Don’t give your insurer more ammunition by posting on social media once you’ve filed a claim.

Stick directly to the language you use in a claim and compare that to your social media activity.

If you report you’re unable to lift more than 20 pounds, you shouldn’t be doing it and you certainly shouldn’t have anything on social media that says or shows you are doing it.

It is very common for people to only show a small – and overwhelmingly positive – portion of your life on social media. This can be especially true for people with disabilities who do not want to seem incapable, or do not want to alienate people by being too transparent about any challenges they experience.

Unfortunately, this does not matter to insurers. The image and information you willingly put online can be taken at face value by insurers and used against you.

What you can do about it?

Stop posting.

This is the smartest move to make when you’re planning to file or have just filed a claim. Insurers may still find ammunition in your older posts, but you can make sure not to give them an more by going inactive on social media.

Some social platforms may give you the option of deactivating your profile, which will temporarily disable and hide it until you’re ready to come back.

Be smarter about how you use social media.

A photo, Tweet or Facebook update that seems innocent to you could be used against you in your insurance claim.

- Don’t post anything on social media that may be minsunderstood.

- Jokes and sarcasm don’t work well on social media, so avoid them if you can.

- NEVER post anything about your claim on social media!

- Remove any photos or posts you’ve been tagged in that might be incriminating – and do it quickly. Your social media accounts will be among the first destinations for claims investigators.

Talk to your friends and family.

Many people cringe when they are tagged in embarrassing photos, videos and posts by friends and family. Unfortunately, what other people post about you or tag you in has other consequences, as it can negatively impact your claim. Once you file a claim, have a discussion with your friends and family about social media etiquette.

- Let them know you do not wish to be tagged, mentioned or included in any social media posts or photos.

- Ask them to be careful who they friend. Don’t accept friend requests from people they don’t know, as claims adjusters may be investigating under a pseduonym.

- If you are tagged in any unfavorable posts, remove the tag yourself, or ask your loved one to do it.

Update your privacy settings.

As our general understanding of online privacy continues to evolve, case law will continue to evolve as well. Currently, information placed on social networking accounts that are not blocked or private is considered to be within the public domain. This means it can be used against you in your insurance claim.

You can adjust your privacy settings on most social media sites to control who sees what you post.

It is crucial to understand that while updating your privacy settings is important, it won’t solve all your problems if you’ve already posted things you shouldn’t have on social media. Our ability to “screenshot” anything on our phones or devices mean that anything can be viewed or shared by anyone. You must also consider that deleting a post doesn’t mean it’s actually gone forever.

Here are some guides on how to update privacy settings on different social networks: