Long Term Care Insurance: Do You Really Need It?

Download this episode:

On iTunes | On Stitcher

According to U.S. News and World Report, only 100,000 traditional long-term care insurance policies were sold in 2015, compared to 700,000 in 2000.

People aren’t buying long term care insurance policies for many valid reasons, but the increasing cost is the most common. However, 9 million Americans over the age of 65 needed assistance in 2012. That number is expected to grow to 12 million in 2020.

Is there a way for millions of Americans to fund their long term care without buying an insurance policy? In this podcast episode, we examine the true need and cost of long term care insurance, as well what your alternative solutions are.

What does long term care insurance cover?

Long term care insurance was created to cover comprehensive long term care costs that traditional insurance ususally does not cover. LTCI can pay for care if you need help with 2 of the 6 activities of daily living (ADL):

- Hygiene (grooming, shaving, and oral care)

- Dressing

- Eating

- Toileting (being able to use the restroom)

- Transferring (getting in and out of bed)

- Ambulating

- OR if you are cognitively impaired

How much does long term care insurance cost?

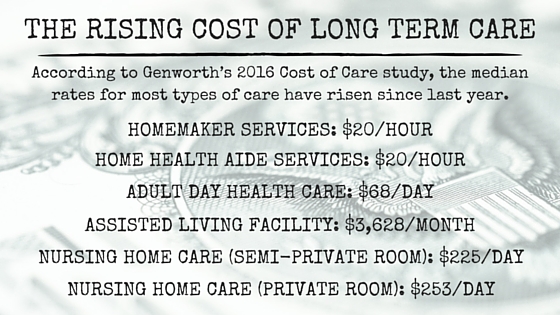

The cost of this insurance depends on a number of factors, including your age, your health status and the optional benefits you may choose.

Alternatives to long term care insurance

Self-insurance

One of the top alternatives to long term care insurance is self insurance, which simply means saving enough money now so you can pay for long term care in the future.

However, this option doesn’t work for everyone; nearly half of U.S. households would have trouble meeting emergency expenses of just $400, and long term care costs add up very quickly.

Medicare/Medicaid

Medicare can pay for long term care, but there are conditions. For example, it does not pay for non-skilled assistance with the Activities of Daily Living, which make up the majority of long-term care services. Medicare coverage of skilled services or rehabilitative care in a nursing home maxes out at 100 days, but the average stay is usually much shorter – just 22 days.

Medicaid does pay for the largest share of long term care services, but it also comes with stipulations. You income must not exceed a certain level and you must meet minimum state eligibility requirements.

Hybrid LTC insurance

Some insurance companies have attempted to solve their long term care insurance problem by combining permanent life insurance with long term care insurance, creating what is known as a “hybrid policy.”

The average cost of a single-premium combination policy is $75,000, according to the American Association of Long-Term Care Insurance.

These policies can be costly, but as LTC insurance premiums continue to skyrocket, hybrid policies become a more reasonable alternative for many consumers.

Traditional LTC insurance, with modifications

If all else fails, there are ways to save money on traditional long term care insurance. Your cost-savings strategies will depend on your financial situation, but common options include:

- Cutting the daily maximum benefit. This can lower your premiums, but is only helpful if you can afford to pay the difference out-of-pocket.

- Limiting the number of years benefits are paid. According to the American Association of Long Term Care Insurance, a policy that covers three years will be about 1/3 cheaper than one with unlimited benefits.

- Increasing the waiting period. This can also reduce your premiums, but is only effective if you can afford to pay for a few months of care.

Bottom line: There is no perfect solution to cover your long term care needs. Most experts recommend on funding through multiple sources, such as a combination of insurance, savings and Medicare, Medicaid and other government programs.